In this lesson you will learn 💸

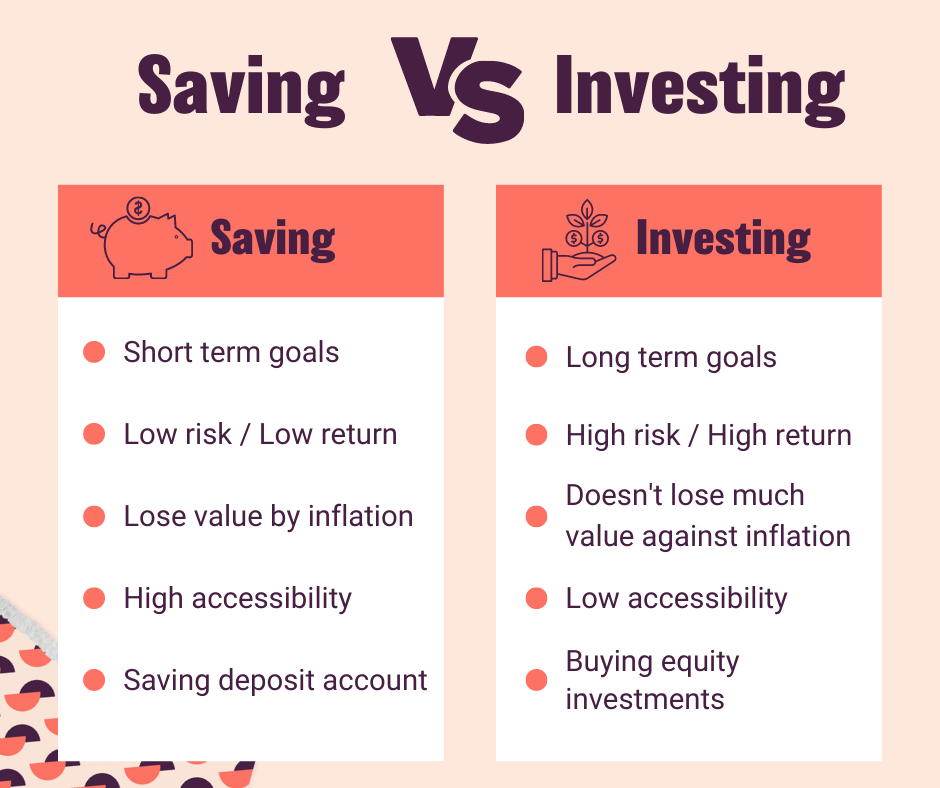

- All about the difference between saving and investing

- What makes money grow (or not): interest and inflation

To make your money grow you have two basic choices

- You can either leave it where it is, e.g. in your bank account, or

- You can invest it

Think of it like fitness. If you want to be healthy, it’s up to you to get active. If you want to be financially secure in the future, it makes sense to do something positive with your money now.

Saving

Is usually for something specific, e.g. a holiday, or a rainy-day fund.

You might allocate a certain amount every month or so and want to keep it somewhere you can access it straight away (such as a savings account).

Investing

Is where you take a chunk of your money and try to make it grow.

You do this by buying something that you think will increase in value. It could be as simple as a collectible Wonder Woman figure, or, more likely, stocks, bonds or crypto.

Types of investment income

When you invest, there are three types of investment income:

What are dividends and capital gains?

Dividends: are a type of income that shareholders of specific companies receive. They are formed from the company's profits and are paid out on a share basis. Shareholders usually have the option to use their dividend cash or reinvest them.

Capital gains: A capital gain happens when you sell an asset for more than what you paid for and are generally associated with investments, but it can also be realized on any possession that is sold for a price higher than the original purchase price.

What is inflation?

The average price increase of goods and services over time (according to the Consumer Price Index). A country in good economic condition is typically accompanied by a steady slow increase in prices. However, if inflation rises sharply, it not only reduces the value of money, but it can undermine trust in that market.

What is interest?

If you’re borrowing money, it’s the extra amount you pay for the pleasure. So, if you borrow CHF 100 at 10% interest, you’d have to pay back CHF 110. However, if you're lending money, you’d lend the $100 and get CHF 110 in return.

What is compound interest?

Time can make a huge difference to the amount of return you’ll see you on your savings and investments. The more interest you make, the more money you’ll accrue (as interest is paid on your interest). This is called compound interest.

Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.