In this lesson you will learn 💸

- How much you need for your emergency fund

- How to plan with the 50-30-20 rule

- How to estimate how much you might need for your retirement

How much should I put aside for what?

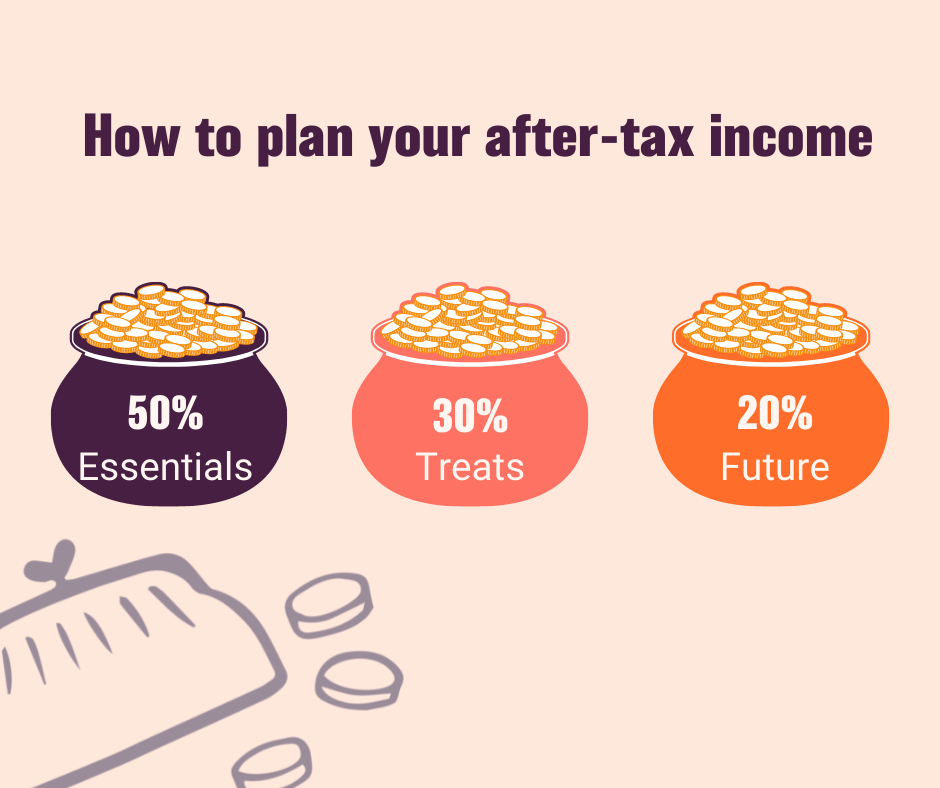

One way to take a shortcut is the so called 50-30-20 budgeting and financial planning rule popularized by Senator Elizabeth Warren in her book, All Your Worth: The Ultimate Lifetime Money Plan.

This rule suggests that you:

- spend up to 50% of your after-tax income on must-have needs and obligations such as groceries, rent, insurance etc.

- spend up to 30% on things that are not essential, but that might make your life enjoyable. We call them treats. Things like dinner and movies out, vacations, that new handbag, the latest electronic gadget...

- try to allocate 20% of your net income to your future savings and investments including your emergency fund and repaying any debt.

How much do I need to put aside for my retirement?

Unfortunately there isn’t a perfect answer as it all depends on individual circumstances.

- Your current lifestyle and the life you want to have in retirement

- When you want to retire - is it the official retirement age, sooner or later?

- Your life expectancy

- Your current situation and if you are facing any retirement gaps

- If you are saving or investing your retirement money

Here are some approximates to help you to take a rough estimate.

Approximates to estimate your retirement amount

You can use the ball park recommendations such as the 50-30-20 rule.

You can use a retirement calculator from the internet, or the SmartPurse retirement and investment calculators.

You can calculate with some simple assumptions as follows - we show for simplicity reason a UK example here:

- Target: 100% of your working income

- Subtract: state pension and employer pension, for Switzerland a ballpark assumption is that pillar 1 and 2 will cover approx. 60-70% of your income in retirement

- Total amount: multiply by years you expect to be retired

- How much to put aside: divide the amount needed for your retirement by total no of years you plan to be working = amount per year you need to put aside

Meet Jane 💁♀️

Jane is 30 years old today, earns CHF 50,000 per year and wants to retire on her 65th birthday.

How much does Jane need to put aside each year?

- Target: 100% of her working income: CHF 50,000

- Subtract state pension and employer pension: 60% of her income should ideally be covered by pillar 1 and pillar 2 = CHF 30,000, this leaves Jane with a gap of CHF 20,000 per year

- How many years will Jane be in pension: she retires at age 65 and has a life expectancy of 85 years = 20 years

Janes total amount therefore is: 20 x CHF 20,000 = CHF 400,000

- How much does Jane need to put aside each year: she has 35 years to work - CHF 400,000 / 35 = CHF 11,428 per year or CHF 952.4 per month (approx. 22% of her gross income)

Please note: in our example, Jane does not invest her money. So this is a simplified calculation to show you how you could estimate your amount.

When it comes to pensions, you might want to get personal advice from a specialist, for example a pension planner or a specialist voluntary service.

Calculate how much to put aside each month

Please login

Our contents are completely advertising free.

To benefit from full access to all of our lessons and webinars, please upgrade your account.

or join one of our live webinars with included 1 month premium access pass.

VIP Coaching is also available for