In this lesson you will learn 💸

- How much you need for your emergency fund

- How to plan with the 50-30-20 rule

- How to estimate how much you might need for your retirement

How much should I put aside for what?

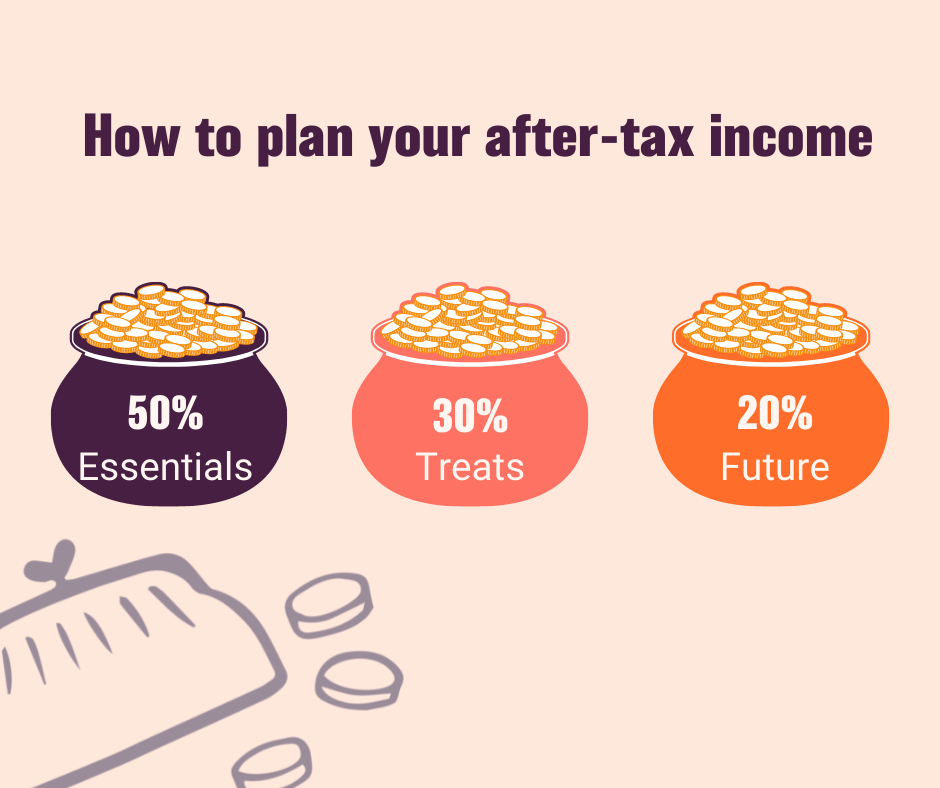

One way to take a shortcut is the so called 50-30-20 budgeting and financial planning rule popularized by Senator Elizabeth Warren in her book, All Your Worth: The Ultimate Lifetime Money Plan.

This rule suggests that you:

- spend up to 50% of your after-tax income on must-have needs and obligations such as groceries, rent, insurance etc.

- spend up to 30% on things that are not essential, but that might make your life enjoyable. We call them treats. Things like dinner and movies out, vacations, that new handbag, the latest electronic gadget...

- try to allocate 20% of your net income to your future savings and investments including your emergency fund and repaying any debt.

How much do I need to put aside for my retirement?

Unfortunately there isn’t a perfect answer as it all depends on individual circumstances.

- Your current lifestyle and the life you want to have in retirement

- When you want to retire - is it the official retirement age, sooner or later?

- Your life expectancy

- Your current situation and if you are facing any retirement gaps

- If you are saving or investing your retirement money

We'll explain much of this in detail in Module 4 "Pensions". For now, here are some proxies to help you to take a rough estimate.

Approximates to estimate your retirement amount

You can use the ball park recommendations such as the 50-30-20 rule.

You can use a retirement calculator from the internet, or the SmartPurse retirement and investment calculators.

You can calculate with some simple assumptions as follows - we show for simplicity reason a UK example here:

- Target: 50-70% of your working income

- Subtract: state pension

- Total amount: multiply by years you expect to be retired

- How much to put aside: divide the amount needed for your retirement by total no of years you plan to be working = amount per year you need to put aside

Meet Jane 💁♀️

Jane is 30 years old today and makes no additional pension contributions. She earns £30,000 per year and wants to retire on her 67th birthday.

How much does Jane need to put aside each year?

- Target: 70% of her working income (0.7 x £30,000): £21,000

- Subtract state pension: the full new state pension is £ 185.15 per week: £ 9,627.8

For simplicity reasons we assume here that Jane get's the full state pension.

In Janes case, she now needs £21,000 - state pension (£ 9,627.8) = £ 11,372.2 per year

- How many years will Jane be in pension: she retires at age 67 and has a life expectancy of 83 years = 16 years

Janes total amount therefore is: 16 x £11,372.2 = £181,955

- How much does Jane need to put aside each year: she has 37 years to work - £ 181,955 / 37 = £ 4,918 per year or £ 409.8 per month (approx. 16% of her income)

Please note: in our example, Jane does not invest her money. So this is a simplified calculation to show you how you could estimate your amount.

When it comes to pensions, you might want to get personal advice, for example an advisor or a foundation like Age UK which has plenty of user friendly resources and a helpline.

Calculate how much to put aside each month

Please login

Our contents are completely advertising free.

To benefit from full access to all of our lessons and webinars, please upgrade your account.

or join one of our live webinars with included 1 month premium access pass.

VIP Coaching is also available for