In this lesson you will learn 💸

- The difference between fixed and flexible income

- How the Swiss three-pillar model works

- What pension options are available for you

Have you ever thought about what you would like to do when you retire - travel? Take care of grandchildren? A holiday home at the beach? For all of this, you need a steady income.

Fixed income

This is the income that is paid out regularly. In retirement, this includes any retirement benefits that you can claim from social security and your employer pension to which you and your employer have contributed.

To supplement your fixed income from the state pension and employer pension, you can add a third pillar, a private pension saving pot, maximise your employer pension contributions or look at additional options such as life insurance. In any case you should ideally strive for a fixed income in retirement that covers in the minimum your basic needs. Please see the following lessons for a quick estimate on calculating how much you might need.

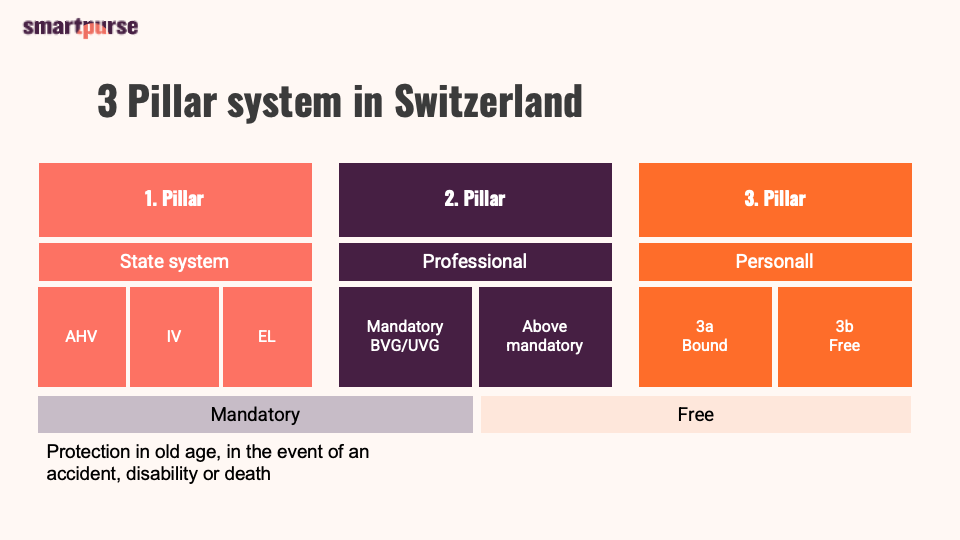

The three-pillar system in Switzerland

The Swiss retirement system is based on three pillars:

What is the idea behind the system?

- The first pillar covers your existential needs

- For everything above your existential needs, you use the second and third pillar

Payments into the AHV - and from the BVG minimum annual salary (as of 2022: CHF 21,510) also into the pension fund - are mandatory. Half is paid by your employer and you pay the other half.

In order to maintain your usual lifestyle and to be really secure, you also need a private provision, the so-called 3rd pillar. This is voluntary and, in the case of the Pillar 3a, contributions are tax-privileged.

1. Pillar: AHV

All employees residing in Switzerland are subject to AHV contributions. The monthly contribution is deducted directly from your salary. Your employer pays one half, you the other half. You can find an overview and more information here.

Important: every contribution gap (missed out year) leads to a later reduction in your pension. You should close such gaps within 5 years. The AHV pension for married couples corresponds to half the sum of both incomes. Attention, if the total pension paid out is 150% above the maximum pension, the individual pensions will be reduced.

Tip 📌

Order the extract of our individual AHV account here. This will show you all you contributions and highlight any gaps you might have.

What are supplementary benefits (EL/PC)

These benefits provide assistance in cases where the pension and income do not cover the minimum living costs.

Pro Senecture offers very good personal guidance should you need to claim supplementary benefits.

2. Pillar: Employer Pension (BVG)

If your salary exceeds the BVG minimum annual salary (as of 2021/2022: CHF 21,510), your employer is obliged to enroll you into employer pension and to contribute at least half of the contributions. The employer pensions are managed by pension funds.

If you are self-employed, you have different options, for example to enroll into a pension fund, or, to make a higher contribution to your private pension (so called big pillar 3a).

What is the conversion rate?

In order to calculate how much you will receive each year, the pension fund calculates your paid-in retirement assets with what is known as the "conversion rate".

Calculation example: With a conversion rate of 6.8% and retirement assets of CHF 350,000, your annual pension would be CHF 23,800.

3. Pillar: pillar 3a and b

The third pillar, your private pension, can be divided into two buckets:

- Pillar 3a tied private provision: taken out with an insurance company, a bank or an online provider. You can use these savings for your retirement or in certain conditions, such as purchasing a house/flat or if you leave the country. Contributions are subject to a annual maximum of appox. CHF 7'000 p.a. and tax deductible (benefits are fully taxed).

- Pillar 3b Free private provision: personal savings, e.g. cash, life insurance, investments. The savings can be freely disposed of at any time. No tax privileges.

Did you know? 📌

The capital paid into Pillar 3a can be withdrawn 5 years before you reach normal AHV retirement age, i.e. at 65. Exceptions are: self-employment, moving abroad or financing home ownership.

Variable income

This is the income you're hoping for but isn't guaranteed. Examples include income from renting out a property, your savings and investments, but also wages if you continue to work beyond your official retirement age. Perhaps you are selling your house or other possessions such as antiques and jewelry.

To Do 📝

- Check the status of your AHV and if possible, close any missing years in contributions.

- Review your employer pension fund statement to know what assets you have and where you stand.

- Set-up a pillar 3a if you do not have one already.

- Decide if you want to look at further options to plan for your future, e.g. private investments, life insurance etc..

- If you live in a partnership, discuss together how you are secured for old age.