In this lesson you will learn 💸

- What different types of debt exist

- How to use debt repayment strategies

- How to set up a debt management plan

What is debt?

Simply put, debt is something that you owe - whether this is money or something more abstract, like a favour to a friend. There is ‘good’ and ‘bad’ debt.

How much debt do you have?

Do you owe everything to one person, or have you got multiple loans to pay back to different people or companies?

If you’ve got just one debt, your plan for repayment is super simple: make the biggest monthly repayment that you can afford, and keep going until it’s all paid off.

However, if you have multiple debts, there are a couple ways to approach it.

Debt repayment methods

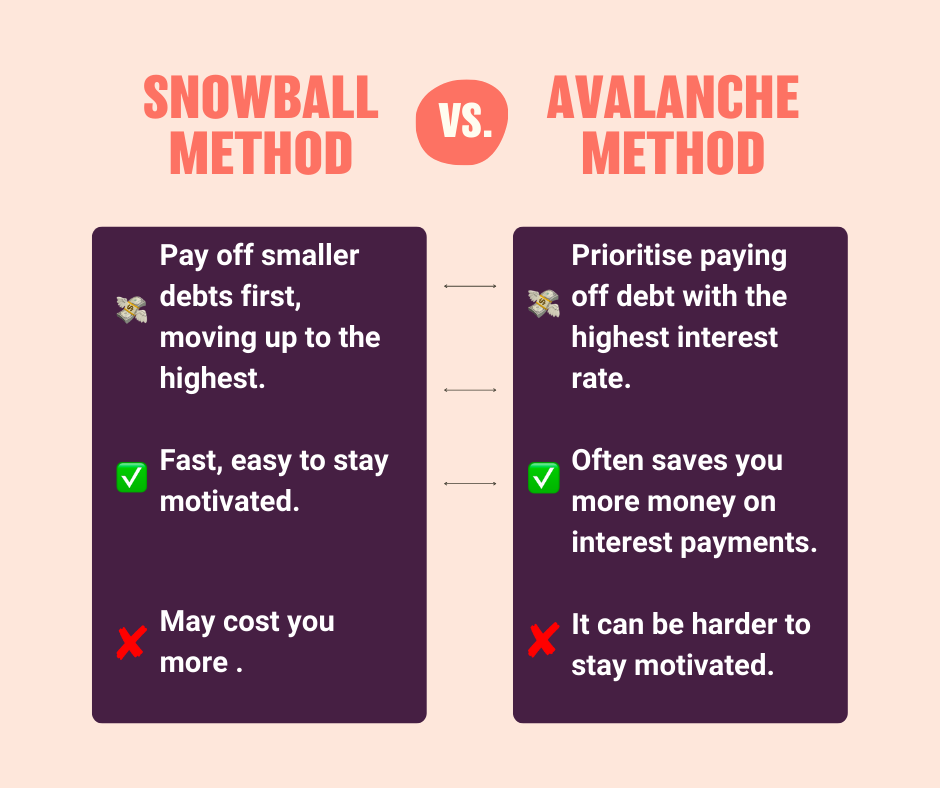

Let’s look at two options, known as the ‘debt snowball’ and ‘debt avalanche’ strategies.

1. Debt snowball ⛷

With this approach, you’ll pay off your debts in order of size, from smallest to largest.

Many people find this motivating, as it involves a series of small successes soon after you’ve started, and this momentum can help you keep ‘snowballing’ towards paying off the rest.

How does it work?

- Make the minimum payments on all of your liabilities

- Put as much extra money as possible towards the one with the least to pay off

- Once it’s gone, move onto the next smallest, and put the payments towards that

- Continue!

This strategy doesn’t take interest rates into account - you’re targeting debts by size alone. But think of a snowball rolling down a slope: as it gets bigger, it can pick up more and more snow. Each debt you pay off gives you more money each month, helping you to pay off the rest more quickly.

2. Debt Avalanche 🏔

With this approach, also known as ‘debt stacking’, you look at the interest rates on the amounts that you owe, and pay off your debts according to those rates, from the highest to the lowest.

How does it work?

- Make the minimum payments on all of your accounts

- Put as much extra money as possible towards the account with the highest interest rates

- Once this debt is paid off, move onto the next highest interest rate

- Continue!

Just like an avalanche, it might take a while before you see anything happen. But when you do pay off a debt, you’ll have even more money to put towards the next one. And since this strategy tackles debt in order of interest rates, you’ll actually pay less overall.

Tip 📌

If you are specifically dealing with credit card debt, here are some tips that might help:

Transfer your balance to a card with a lower interest rate. This might seem like you’re just moving the problem around, but you’ll build up less interest, meaning you have less to pay back overall. This can work well together the avalanche method. You might have to pay a balance transfer fee though, so check and do the maths to make sure you’re getting a worthwhile deal first.

For large credit card balances another option could be to take out a personal loan. If you can get a loan with a lower interest rate than that of your card (which is pretty likely), it’s a good swap.

Time to tackle your debt

To help you get the snowball rolling, we’ve got our own Debt Snowball Calculator for you to use.

Download your debt snowball calculator here

Please login

Our contents are completely advertising free.

To benefit from full access to all of our lessons and webinars, please upgrade your account.

or join one of our live webinars with included 1 month premium access pass.

VIP Coaching is also available for