In this lesson you will learn 💸

- What financial bias is and how it can affect your money

- How we can work to close the gender pay gap

- Three ways that you can protect your mindset (and your wallet) from financial bias

On top of the historic exclusion from financial matters, many women and non-binary people still face systematic disadvantages in the world of money - these are often cases of ‘financial bias’. One really tangible example of how financial bias can lead to serious inequality is the gender pay gap, which as of today, still exists all around the world.

What is bias?

Bias is a (usually unfair or unfounded) prejudice against someone or something. Financial bias, then, is a prejudice or belief that one group is better equipped to handle money than another.

When it comes to our money, there are two main types of bias to consider:

- Cognitive bias: when a person is using faulty logic, or perhaps has misunderstood information, and makes a judgement without realising their mistake.

- Emotional bias: is related to feelings, perceptions or beliefs about someone or something. When it comes to investing, emotional biases can cause irrational mistakes.

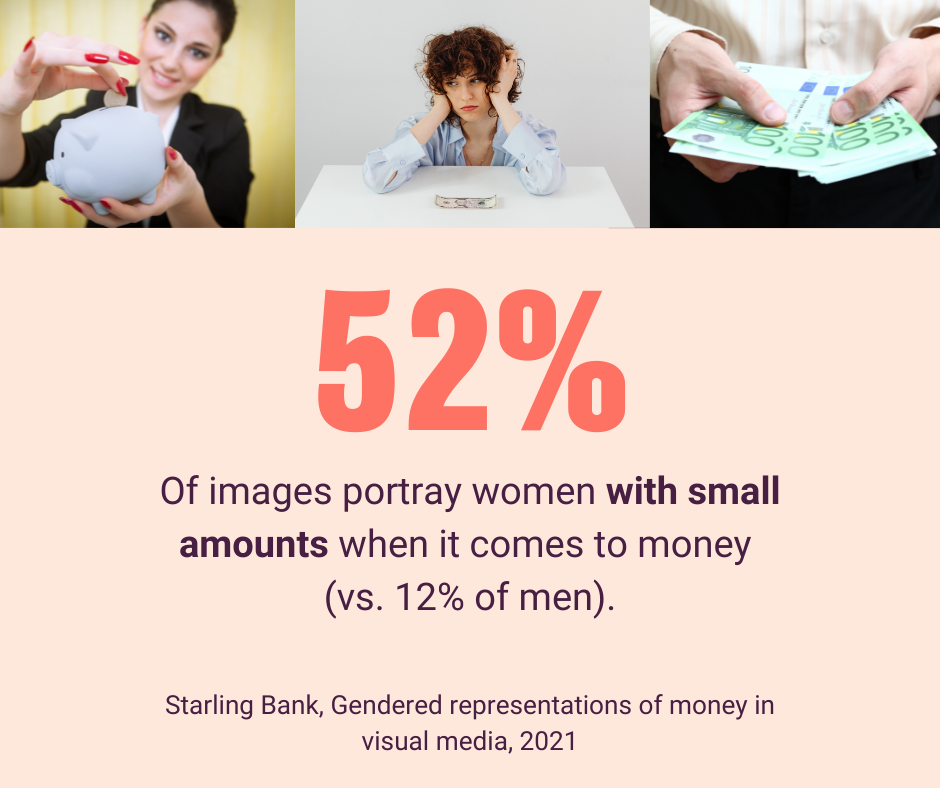

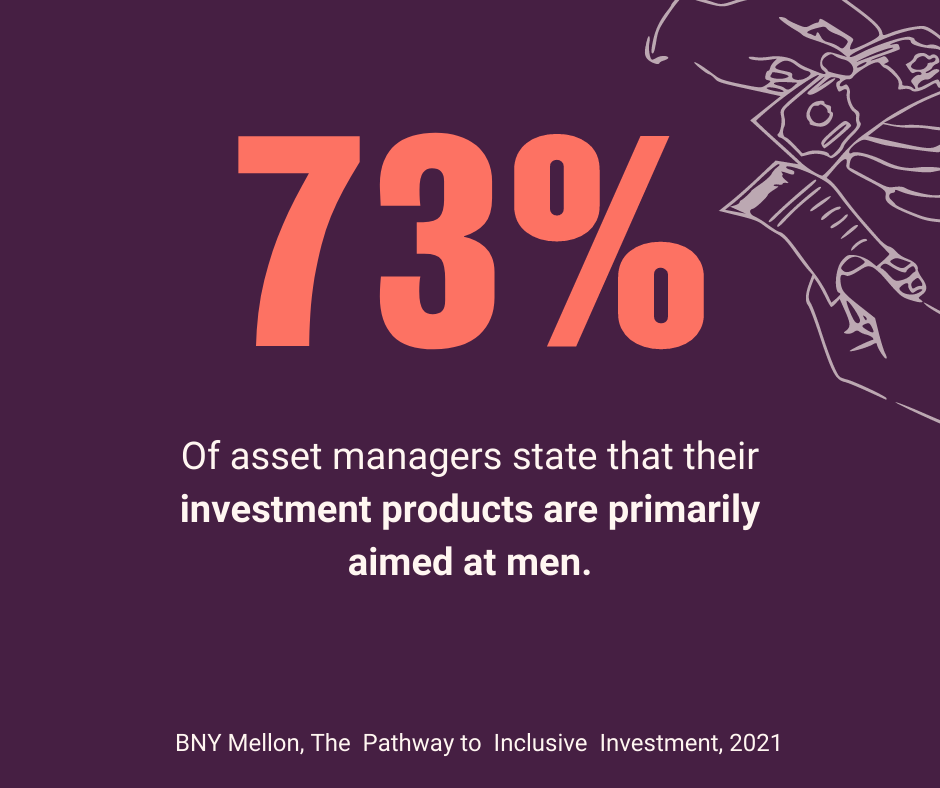

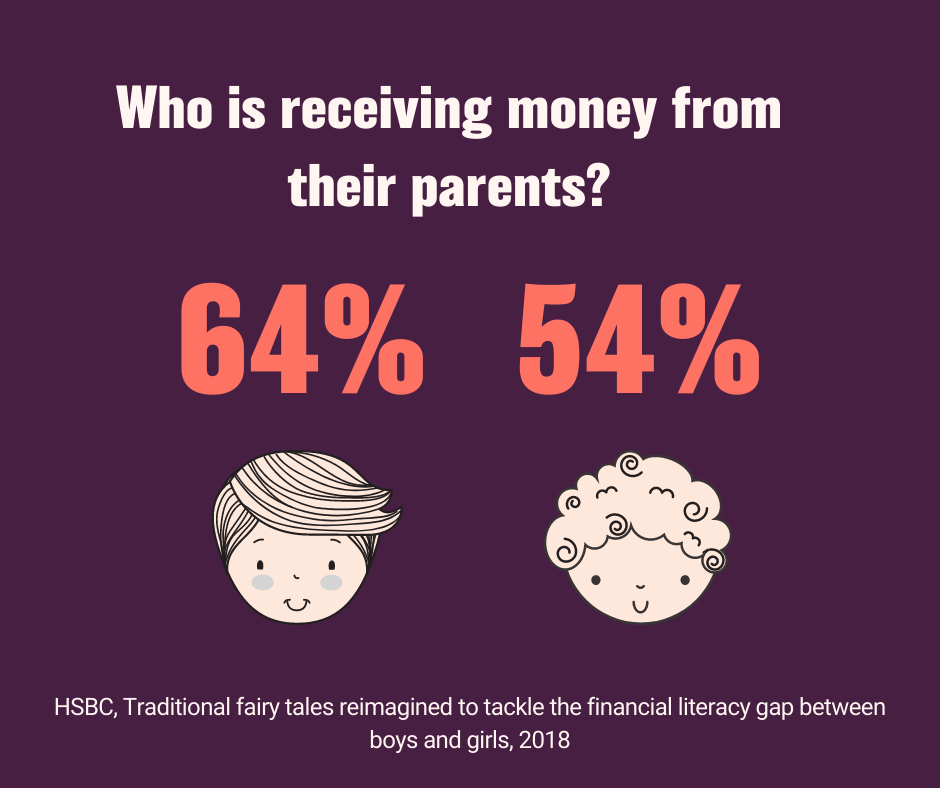

Common biases when it comes to women and money

Here are some examples:

All these biases can influence our money mindset as well as how confident we feel taking financial decisions, so it is worth being aware of them and most importantly actively fighting them!

The gender pay gap

Globally, women earn around 37% less than men in similar roles, according to the Global Gender Gap Report 2021 from the World Economic Forum. There are three main factors which contribute to the gender pay gap:

- Job segregation

- Inflexible working practices

- Pay discrimination

One of the main challenges of the gender pay gap is, that over a lifetime it translates into massive pension gaps and wealth gaps. Combined with other characteristics of women's unique lives such as longer life expectancy and part-time work, it not only leaves women financially disadvantaged now, but also with the risk of running out of money when we are old.

The good news...😊

...is that financial planning and investing (even with small amounts!) can help a lot to mitigate some of these gaps. More on this in the modules and lessons throughout the Money School. For now, let's take a look at what you can do to tackle the stubborn gender pay gap.

Are you not sure if you’ve been impacted by the gender pay gap?

Here are two questions and a comparison to help you figure out…

- Do promotions in your workplace demonstrate a gender imbalance? If fewer women are given promotions, this means that the senior level of your organisation is largely made out of men. Not only do these positions receive higher pay, but they also have a huge hand in determining who will get future promotions, which can continue this imbalance.

- Can part-time employees progress in your organisation? It might be the case that part-time employees can’t rise to senior roles in your organisation, which impacts how much they can earn. This is a gender issue because women are more likely to take on part-time work after returning from maternity leave, for example.

Find out where you stand

There are various tools in Switzerland that you can use to compare your salary:

Salarium, statistical salary calculator

Lohncheck.ch (in German)

According to the Equal Opportunities Act, all companies with more than 100 employees are obliged to carry out an equal pay analysis from July 1st, 2021. Visit Respect8-3 to find out which companies participate.

For a global comparison on how gender pay regulations across the world might be affecting your company use the PricewaterhouseCooper'sGlobal Gender Pay Compass

Your action 📝

- Talk about biases you perceive: if you believe your company is contributing to a gender pay gap, talk to your colleagues, male, female, non-binary… See if there are any glaring patterns in the way that salaries are determined, and then bring them forward.

- Check if and how you are impacted by the gender pay gap and address this with your employer.

- Undo your own biases: although we hate to admit it, financial biases can slip in unnoticed sometimes, convincing us that sustainable investments are ‘less profitable’, or that robo-advisors aren’t ‘trustworthy’, for example. One of the best ways to protect your mindset is to continue educating yourself and undoing any damage done by past biases.