In this lesson you will learn 💸

- About the different groups of financial assets

- How they behave in relation to risk and expected outcomes

Did you know, that you can group different investments according to their characteristics?

Once you’ve got similar products together in their respective 'asset classes' you can start comparing them – just like you’d compare washing machines or HDTVs. We’ll look at these asset classes in more detail in a minute.

What are 'financial assets'?

Financial ‘assets’ can refer to a whole host of things; from property to collectables, currencies to shares. In a nutshell, they refer to anything that either has intrinsic value or can be converted into something of value.

When they’re grouped together, according to similar characteristics, they’re known as 'asset classes'.

What are the main asset classes?

The most important of asset classes are cash, equities and fixed income but you can also have property, commodities and alternatives:

Cash

The obvious advantage of cash is that it’s extremely liquid (you can access it any time). It’s typically held in a bank in a current, savings or term account. It has a very stable value but with little or no return.

Fixed income

Government and corporate bonds are the most common types of fixed-income products. Investors lend money to a company or government in return for regular interest payments. When the debt matures, the investor gets their original money back. Government bonds are very liquid, as are many corporate bonds. Examples include bonds of BMW and HSBC.

Property

As you’d expect, this is where you invest in either residential or commercial real estate. As well as the value of the property increasing in value, you earn extra returns from rental income. Your investment is less liquid compared to other assets but the value is more stable. As it typically involves large investment amounts concentrated in one object (also see our article Is it better to buy a house or rent it for more information), many investors like to buy shares in a real estate investment trust (REIT), which is listed on major stock exchanges, just like any other public stock.

Commodities

This is where you invest in raw materials like gold, oil or gas. Liquidity depends on the commodity you buy. Movements in value can be very large and this is where you make your returns.

Equities/stocks

Stocks mean that you take part ownership in a company (although usually only a tiny fraction). The stocks of larger companies are traded on the stock exchange. The value of your investment will move all the time, with considerable swings of fortune. Returns come in the form of dividends. These are variable and change in value. Large company stocks are very liquid. Examples include: Vodafone, Coca-Cola and Barclays stocks.

Alternatives

This is a broad term for less or non-traditional assets like hedge funds, derivatives, bitcoins and currency. Value movements and liquidity vary hugely between these different assets and they are typically only recommended for very experienced investors.

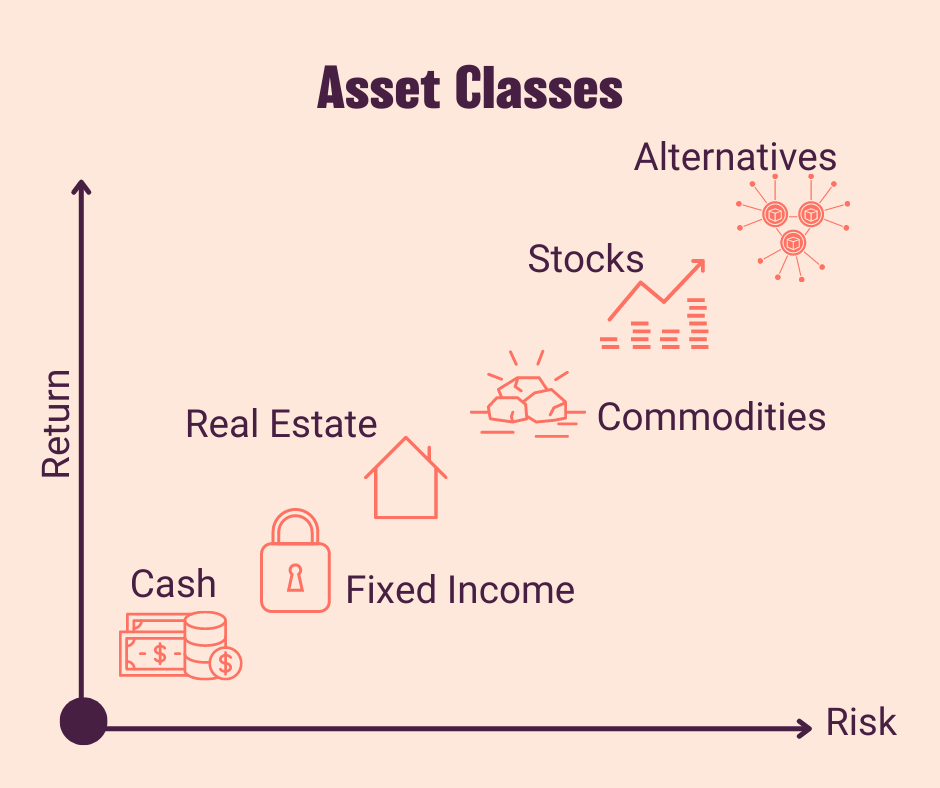

How do different asset classes behave when it comes to risk and return?

The graph below shows you some asset classes in an overview and how their risk-return profiles look like:

Key takeaways

Asset classes define nothing else than groups of assets or investment products with similar characteristics. You can also compare this with cars, for example: there are different 'groups' of cars - small city cars, SUVs, sport cars, family cars etc. but in each 'group' there are different products available.

Your action 📝

With all of this in mind, are there any asset classes that you feel could be a good starting point for you to begin investing?

Which ones do you feel most comfortable with and why?

Note it down, it will help you in chapter 2 of this module, when you set-up your investments.